This was a busy week under the Gold Dome. The Housed passed many measures, including the Fiscal Year 2022 Budget and the Republican voting bill limiting early voting, changing absentee balloting, and implementing many other measures designed to make it harder to vote. Below I summarize some of the highlights and lowlights of this week’s activity in the House.

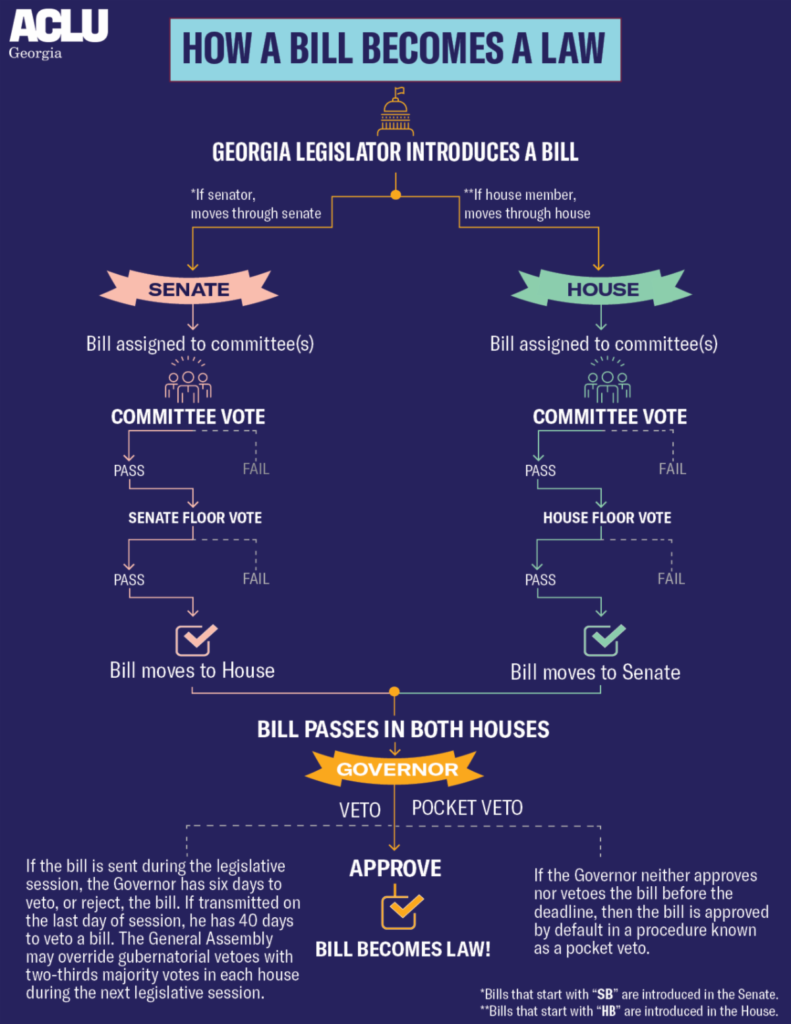

On Monday, we will be back at the Capitol for Day 28/Crossover Day. This is one of the longest days in our legislative session—we’ll likely be voting until midnight. “Crossover Day” is aptly named because it is the last day a bill must pass either the House or Senate to survive for the session. Tuesday, I expect the Speaker will assign the Senate bills that “crossed over” to House committees, and we’ll begin hearing them right away as we sprint toward March 31st, 2022, the last day of the session.

Remember you can watch us in action. To watch floor sessions and committee hearings, visit this LINK to view the schedule.

Pushing for Community Schools

Thank you to everyone who came to our recent town hall on HB 201, the community schools bill I introduced earlier this session. If you missed it, you can watch HERE. I loved hearing how other states are taking different approaches to educating our children and engaging the community.

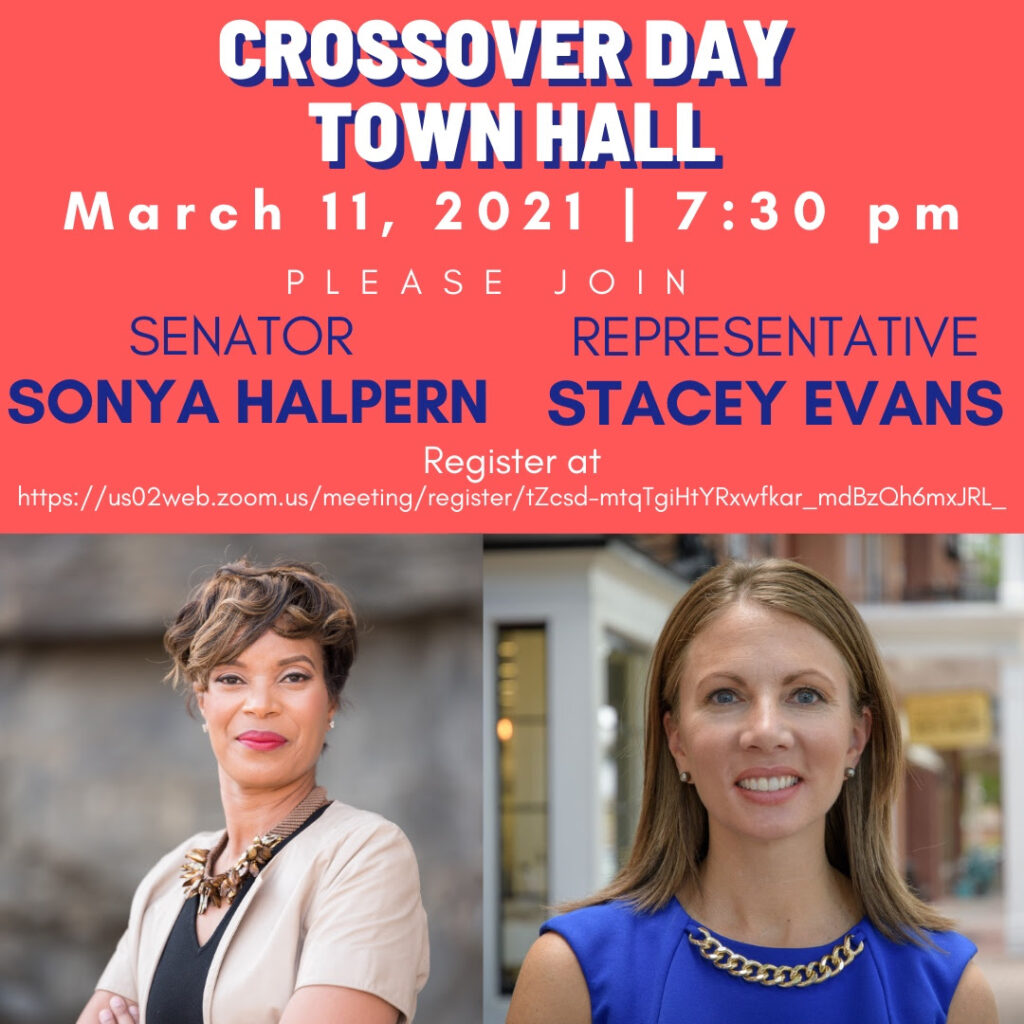

Crossover Day Town Hall

Senator Halpern and I are teaming up again for a town hall meeting to review the legislation that survived Crossover Day. I hope you can join us!

Bills that Passed the House this Week

The Budget

Put simply, the budget process works like this:

- The Governor sets the revenue estimate (the amount the State is authorized to spend for the fiscal year) and makes recommendations for amounts of money allocated to each department.

- The House reviews those recommendations and makes changes

- The Senate makes further changes.

- House and Senate leaders meet in a conference committee to create one joint recommendation for the House and Senate to pass.

- The Governor has the final say on the Budget. He can sign it as is, or he has the power to line-item vetoes of any particular budget item.

This week the House passed its recommendations for the Fiscal Year 2022 Budget (July 1st, 2021-June 30th, 2022). Now the Senate will have its turn to weigh in on the Budget.

Usually, when the Governor sets the revenue estimate, that’s the end of it. But this year, the Governor’s original revenue estimate did not include $7,638,448 in funds received from the excise tax on for-hire ground transportation authorized last session. The Governor amended his revenue estimate to add this amount for spending in the 2022 Budget. In a huge and wonderful move for transit, the House recommends this entire amount be allocated for transit projects, including $7 million for MARTA.

Voting on any budget is never easy. My philosophy is to consider whether the proposed budget is an improvement over the current state of affairs, and if it is, then I vote yes. This year, that was the case as the 2022 Budget adds additional funds for education, transit, mental health, and many other vital services.

This doesn’t mean that the 2022 Budget is perfect. And it certainly doesn’t mean that I believe the amounts added are enough. We need to do more. And we still need to consider increasing our revenue by increasing the tobacco tax and reviewing corporate tax breaks. But, on the whole, this Budget is an improvement over the current fiscal year.

Nearly 90% of the new revenue for FY 2022 is set to be spent within education and health and human services agencies. The Governor’s recommendation included a 60% restoration of the reductions made to the K-12 education funding formulas in 2021. We improved on the Governor’s requests by providing funds for expanded mental health care and crisis intervention services, rate increases for health and human service providers, healthcare access, and salary increases for critical positions. Highlights of the House version of HB 81:

Criminal Justice, Public Safety and the Courts

- Provides the GBI with $1.59 million to annualize the recruitment and retention of medical examiners. The recommended caseload for medical examiners is 250 autopsies per doctor annually. Due to staff vacancies because of low wages, Georgia medical examiners perform nearly 100 more autopsies annually than recommended. Enhancing the medical examiner’s salary will make Georgia competitive and improve retention and recruitment of these specialized doctors.

- Fully restores $700,000 for domestic violence shelters and sexual assault centers cut from the FY 2021 budget. We added $238,317 to provide a 2% increase in state funding for all domestic violence shelters and $150,000 to bring two new shelters up to the minimum state funding level. From 2019 to 2020, there was a 46% increase in domestic violence program crisis calls and a 90% increase in sexual assault program crisis calls.

- Juvenile correctional officers receive a targeted 10% pay increase to combat the 97% turnover rate within the Department of Juvenile Justice. In the Georgia Department of Corrections, correctional officers receive a 10% targeted pay raise to combat the 35% turnover rate within the department.

- Adds $532,874 to the Department of Public Safety to create two additional salary steps for seasoned troopers who stay in the field rather than move to an administrative role. The new pay scale will allow troopers with 12-19 years of experience to receive the title senior trooper and a 2.5% pay increase; troopers with 20 years of experience or more will receive the title master trooper and a 5% pay increase.

- Provides $2.1 million to restore reductions made throughout the Judicial Branch in the FY 2021 budget; $1.9 million for the recruitment and retention of assistant district attorneys and assistant public defenders; and $1.18 million for seven additional assistant district attorney positions and five assistant public defender positions to serve juvenile courts.

Economic Development

- Adds $307,460 to annualize four positions and operating expenses needed for the Georgia Hemp Program and $333,350 to establish the Farmers and Consumers Market Bulletin as the official regulatory and educational tool for the Georgia Agricultural Tax Exemption (GATE) program.

- Despite the global pandemic, the Department of Economic Development has seen a surge in businesses looking to relocate to Georgia. We included $85,860 for one new project manager position in the Global Commerce program to accommodate this growth.

- Provides $2.5 million in one-time funds to the Georgia World Congress Center Authority, which has experienced a decline in revenue for operations due to the impact of COVID-19.

Education

- K-12 education is the largest single expenditure in the State’s Budget, totaling $10.2 billion, or 43.8% of the state general funds budget. The FY 2021 budget included a reduction of $950 million to the Quality Basic Education formula (QBE) due to a decline in state revenues resulting from the COVID-19 pandemic; HB 81 restores $567 million, or 60% of that reduction, to the QBE formula earnings. The sustained decrease to QBE is now $383 million, or (4%).

- $5 million increase in funding for the nutrition program, providing additional funds for the state share of nutrition worker salaries and a supplement for nutrition managers. The extra $5 million brings the total Nutrition program appropriation to $29.5 million.

- $179,152 in additional formula funds for pupil transportation. We also include $2 million in bond funding to incentivize alternative fuel school buses; in FY 2021, DOE approved the purchase of 158 propane buses in 13 counties across Georgia. School systems save an estimated $3,500 in maintenance costs per propane bus.

- Restores the $700,000 reduction to feminine hygiene grants taken in the FY 2021 budget and increases the original appropriation by $250,000 for a total of $1.25 million in FY 2022.

- Also, language is added directing the Department of Education to prioritize grants to school systems with low property tax wealth and a high percentage of economically-disadvantaged students.

- Increase of $3.5 million to the Department of Early Care and Learning to fund an additional 625 slots in the Childcare and Parent Services (CAPS) program. The CAPS program assists low-income families with the cost of childcare and currently serves more than 50,000 families.

- Increases Lottery funds for Pre-K classroom operations by $1.7 million, or 2.5%. This is the first increase in operations since FY 2010.

- $197,002 for the Troops to Teachers program, a program that offers a path for military members to become classroom teachers.

- $100,000 for the Growing Readers program in the Governor’s Office of Student Achievement, bringing total program funding to $1.6 million. This program has 38 certified specialists working with 85 schools in all 16 RESAs with a goal of students reading on grade level by the end of the third-grade.

- $1.6 million for a $0.25 increase, from $15.50 to $15.75 to the benefit multiplier for retired members of the Public-School Employees Retirement System (PSERS).

- Throughout the Budget, school systems receive an additional $58.1 million for Teachers Retirement System (TRS) annual required contribution rate increases. When funding for higher education is included, the total new state fund investment in TRS for FY 2022 is $66.5 million. These funds will support 131,820 retired and 226,366 active members.

General Government Services

- Provides $650,000 to the Department of Audits and Accounts for auditing expenses related to federal pandemic aid. The Budget also restores $350,000 to the department for software maintenance expenses.

- Includes $761,100 for the Government Transparency and Campaign Finance Commission for five positions and expenses related to the new e-filing system.

- Includes $3.2 million for the Department of Driver Services to increase salaries for critical positions with high turnover. These employees ensure only the safest drivers are on Georgia’s roads.

- The Budget also provides $250,000 for a new Voter Identification Outreach program to remove the financial barrier to obtaining a state photo ID for voting and other official processes that require one.

- Nearly $2.5 million to the Office of the Commissioner of Insurance for 17 positions and operating expenses. These funds will help the department investigate insurance-related fraud cases and provide inspectors to ensure new buildings’ safety across the State.

- $20.7 million to the Department of Natural Resources for the second year of the Georgia Outdoor Stewardship Program. This program provides dedicated funding to state agencies, local governments, and specific non-governmental organizations for parks, trails, and conservation efforts.

- Includes over $1.1 million for the Department of Revenue for 15 positions and three contractors to regulate the distribution and sale of vaping products (HB 375, 2020 Session). The Budget also provides an additional $25 million for the Forestland Protection Grants program, bringing the program’s total funding to $39 million. The grants help local governments offset lost tax revenue and encourage the conservation of the State’s forests.

Health

- Provides $25.3 million for a 10% rate increase for home and community-based services providers, including CCSP, SOURCE, and ICWP waiver providers.

- Adds $7.1 million to increase 18 select primary care and OB/GYN codes to 2020 Medicare levels to support providers with the cost of treating patients.

- Gives $4.86 million to the Department of Community Health’s (DCH) Healthcare Facility Regulation program for contractual services to immediately address the nursing home survey backlog. We also added $7.5 million to annualize a hiring and retention plan to stabilize the nursing home regulatory program’s staffing. These funds will ensure that the program is brought into and remains in compliance with federal requirements.

- Provides $35 million to DCH to annualize the state match of the Disproportionate Share Hospital (DSH) payments for privately deemed and non-deemed hospitals that serve a large number of Medicaid and uninsured individuals.

- $1.5 million is provided for the new vaccine management system’s ongoing maintenance and operations funded in the Amended FF.Y.2021 Budget.

- Provides $506,000 to support Grady Memorial Hospital’s efforts to continue coordinating emergency room use in the 13-county metro Atlanta area.

- Provides $200,000 for feminine hygiene products to be available in public health departments to meet women and girls’ needs outside of school hours. This funding is also the $950,000 provided to the Department of Education for feminine hygiene grants for local school systems.

Higher Education

- Includes $58.9 million for the University System of Georgia (USG), reflecting a 0.8% increase in credit hour growth and a 0.6% increase in square footage. HB 81 also restores $70.1 million in formula earnings not initially funded in FY 2021.

- Adds $500,000 for an eminent scholar for sickle cell research. These funds will be combined with matching research funds from partners at Morehouse College, Children’s Healthcare of Atlanta, and Emory University.

- To create parity between higher education programs and K-12, HB 81 includes $8.1 million for University System of Georgia B-Unit programs. These funds restore 60% of the reductions from the initial FY 2021 budget. These programs include: Agricultural Experiment Station ($2,851,620); Cooperative Extension Service ($2,652,325); Forestry Cooperative Extension ($64,122); Forestry Research ($198,527); Georgia Tech Research Institute ($359,041); Marine Institute ($71,707); Marine Resources Extension Center ($83,486); Medical College of Georgia Hospital/Clinic ($1,627,793); Georgia Youth Science and Technology Center ($53,733); and the Veterinary Medicine Experiment Station ($162,000).

- $6.1 million for a formula increase for the Technical College System of Georgia (TCSG) and restores formula earnings of $3.5 million for FY 2021 not funded initially.

Human Services

- Restores $58.5 million for the Department of Behavioral Health and Developmental Disabilities, which includes an additional $36.3 million over the Governor’s recommendation.

- To combat the negative impact of COVID-19 in mental health and addiction, the House adds $9.2 million for core services to increase the service capacity and promote the State’s providers’ funding equity. This investment allows the State to serve an additional 7,415 individuals per year.

- Additionally, $394,289 is added for suicide prevention services, including funds for suicide prevention training in schools and the State’s first suicide epidemiologist.

- Annualizes $7 million in the Department of Behavioral Health and Developmental Disabilities for a new 16-bed behavioral health crisis center to expand the State’s crisis system’s service capacity. This innovative center will serve individuals in crisis and have both a mental health diagnosis and an intellectual or developmental disability.

- Provides $12.3 million for a 5% rate increase for providers, contingent on the Centers for Medicare and Medicaid Services’ approval. $4.6 million is also added to fully restore the FY 2021 reduction to non-waiver services in family support.

- $621,630 is added for six forensic peer mentors to continue the mission of criminal justice reform. These mentors play an essential role in strengthening the workforce by providing valuable transition and re-entry support for citizens released from incarceration.

- Restores $951,700 in Child Welfare Services for contracts for educational services with the Multi-Agency Alliance for Children (MAAC) to allow an additional 431 children to be served.

- Provides $1.2 million for 17 new positions in elder abuse investigations and prevention. These positions will decrease the caseload ratio for elder abuse caseworkers from 1:33 to 1:23.

Transportation

- Includes more than $200 million in increased motor fuel funds in the Georgia Department of Transportation’s (GDOT) budget. We added an increase to the Capital Construction program of $160.7 million; an additional $21.6 million in Local Maintenance and Improvement Grants; $35.2 million in Routine Maintenance; and recognizes the use of $67 million in ‘Coronavirus Response and Relief Supplemental Appropriations’ (CRRSA) funds to Capital Maintenance.

- $7.6 million in collected ride-share fees provided for by HB 105 (2020 Session). After receiving a revised revenue estimate from the Governor, the House uses these funds to boost the Intermodal program by $638,448 for transit programs across the State; add $1 million in funding for Athens-Clark Transit; and fund $6 million to the Metropolitan Atlanta Rapid Transit Authority (MARTA). MARTA will use the funds to complete improvements at its Bankhead Station to improve accessibility near the newly announced Microsoft campus.

- Payments to State Road and Tollway Authority (SRTA) recognize $38.8 million in a Guaranteed Revenue Bond Debt Service Reserve to establish the Financing Strategy for Tolling Resilience (FSTR). This new program will allow SRTA to restructure debt obligations, leverage favorable interest rates, and provide future project flexibility. The Authority anticipates more than $400 million in savings to the State over the 30-year term.

- The bond package includes $10 million to upgrade state-owned short line railroads to Class II standards to reduce truck traffic on state highways. The Budget includes $100 million for capital road projects and bridge replacements across the State to continue infrastructure investment.

Courts

I was proud to support these bills that recognize and take advantage of technological advancements.

HB 334 allows online notarization of documents instead of requiring an in-person interaction and “wet ink” signature. The bill does not change our status as a “closing attorney state,” meaning a Georgia attorney must oversee all real estate closing transactions in our State.

HB 371 allows judges to conduct hearings in civil cases via telephone or video conference in certain circumstances. This bill does not apply to criminal trials.

Criminal Law

HB 322 removes references to prostitution from the definition of “sexual exploitation of children” in Georgia law. This is a recognition that children are not capable of prostitution. I was glad to vote yes.

HB 363 expands the definition of the “abuse of access” crime against the elderly to include “the illegal taking of resources belonging to a disabled adult or elderly person when access to the resources was obtained due to the disabled adult’s or elder person’s mental or physical incapacity.” It also adds “abuse of access” to the list for methods/actions that qualify as “exploitation.” I support this change.

HB 94 makes the taking of a package from someone’s porch a felony (punishable with up to 5 years of jail time) regardless of the value of the package stolen. I voted no on this bill. If the bill had a value requirement (as we do for other felony offenses), I could have voted yes. I also could have voted yes if we used a stepped-up punishment system, for example, if we charged the first offense as a misdemeanor and subsequent offenses more harshly.

There was a second part of the bill that is good policy, in my opinion, it punishes stealing of mail from a mailbox as a felony if an offender has 10 pieces of mail from at least 3 different addresses, which would lend to punishing true intentional and malicious acts of stealing mail.

Education

I was happy to support HB 32, which creates a refundable income tax credit for a teacher recruitment and retention program to encourage teachers to teach in our most vulnerable schools. Up to 1,000 teachers may take advantage of the refundable tax credit of $3,000 per school year for a maximum of five years to teach in up to 100 rural and low-performing schools, which the State Board of Education will identify.

Elections and Voting

HB 531 is an omnibus bill that incorporates several measures, which are listed below. I voted no on this bill. We should be working to make voting easier, not harder, which many of these provisions will do.

- HB 59: Provides for instant run-offs ballots for military and overseas voters. Shortens the run-off period for federal elections.

- HB 62: Bans election superintendents and board of registrars from accepting private grant funds.

- HB 64: The death of a candidate that wins the election is treated as a failure to fill the office.

- HB 136: In counties with no boards of election, the Chief Superior Court judge can appoint an election superintendent if the probate judge cannot perform the duties.

- HB 227: Requires driver’s license number or photo identification with the absentee ballot by mail application. Secretary of State is banned from mailing out absentee ballot applications unless requested by the voter. It makes handling a completed absentee ballot application a misdemeanor. Third-party organizations can only send blank absentee ballot applications with a disclaimer to voters.

- HB 250: Early vote locations must be advertised and cannot be removed after the notice is published.

- HB 270: Shortens the period to submit absentee ballot application.

- HB 461: Allows counties to open and scan absentee ballots beginning the third Monday before election day.

- HB 492: Replaces Secretary of State as chairman of State Election Board with a chairperson elected by the General Assembly.

- HB 512: Shortens advance voting period and limits voting hours.

- HB 757 (2020): Ends jungle primaries.

- SB 93: Bans mobile voting except during emergencies declared by the Governor.

What it does by section:

- Section 6: Allows counties to hire poll workers from adjoining counties.

- Section 9: Counties are required to split a precinct or provide additional voting equipment for the next general election if wait times exceeded one hour on election day during the last general election.

- Section 12: Allows counties to reduce the number of voting machines during all elections, not a statewide general election.

- Section 13: Requires ballots to be printed on security paper.

- Section 14: Requires counties to provide public notice of the date, time, and place of the testing of their voting systems.

- Section 16: Limits the number of drop boxes allowed in a county.

- Section 17: Requires voters to provide personal identifying information with their absentee by mail ballots.

- Section 20: Requires poll watcher training.

- Section 21: Bans line-warming.

- Section 22: Eliminates/rejects provisional ballots for persons that vote in the right county but wrong precinct.

- Section 25: Requires the election superintendent and one person from each political party to be appointed to the duplication panel in partisan elections. During non-partisan elections, the duplication panel must include the election superintendent and two electors (the bill does not reference the two electors’ party affiliation).

- Section 26: Requires election superintendents to certify elections the second Monday following the election – this is changed from the second Friday.

- Section 31: Makes it a felony for a person to deliver or return another person’s absentee ballot to the board of registrars.

- Section 32: Allows reapportionment of districts to be effective for any special municipal election or general municipal election if the census data is published within 120 days of the election. (Census data is expected to be published this fall).

Environment

HB 647 fter they are sealed. While this is an improvement over the current (mostly non-existent regulation of coal ash storage), much more is needed to protect our groundwater and soil from coal ash contamination. Currently, state law provides for more regulation of household trash regulation than it does of coal ash, which is known to contain many carcinogenic heavy metals, among other dangerous elements. I voted yes for the improvement, but I look forward to our State stepping up and providing much more needed oversight to protect our environment and citizens.

Finance

I was proud to support the following common-sense measures.

HB 593 provides some tax relief for working families by increasing the state standard deduction from $4,600 to $5,400 for single taxpayers or heads of household, $3,000 to $3,550 for married taxpayers filing a separate return, and $6,000 to $7,100 for married couples filing a joint return effective beginning the 2022 tax year. This tax relief applies only to filers who do not itemize deductions.

HB 586 helps our Arts Community by providing for the exemption of sales and use taxes for sales of tickets, fees, or charges for admission to a fine arts performance or exhibition conducted in a facility owned by a 501(c)(3) organization or a museum of cultural significance and would sunset December 31st, 2022.

In the 2020 election cycle, we voted on statewide a referendum, commonly known as “putting the trust back in the trust fund.” HB 511puts this into law, and I support this measure. HB 511 ensures that when Georgians approve fees to cover certain expenses, those fees go to that specific purpose. The bill would establish the initial set of trust funds under the newly enacted amendment to the Georgia Constitution, allowing the General Assembly to dedicate money collected from fees for their stated purposes.

The bill dedicates relevant fees for the next 10 years and would create the framework to collect and appropriate those funds as distinct fund sources in each appropriation bill. The bill dedicates relevant fees for the next 10 years into the following trust funds:

- Georgia Outdoor Stewardship Trust Fund

- Wildlife Endowment Trust Fund

- Solid Waste Trust Fund

- Hazardous Trust Fund

- State Children’s Trust Fund

- Trauma Care Network Trust Fund

- Transportation Trust Fund

- Georgia Transit Trust Fund

- Georgia Agricultural Trust Fund

- Fireworks Trust Fund

Healthcare

I was happy to support these bills that I believe will lead to more Georgians getting access to healthcare and improving health outcomes.

HB 369 would allow advanced practice registered nurses (APRNs) and physician assistants (PAs) to authorize Schedule II prescriptions in emergencies if included in the nurse protocol agreement. To do so, the APRN or PA must have evaluated the patient themselves and are only authorized to prescribe a five-day supply. Also, they must notify the delegating physician within 72 hours. APRNs and PAs must take an additional hour of continuing education biennially on Schedule II controlled substances’ appropriate ordering and use. Lastly, HB 369 would allow APRNs and PAs the ability to authorize disability parking permits.

HB 539 adds a definition for “institution” as it relates to the “Medical Practice Act of the State of Georgia” to allow more physicians that graduated from international medical schools to practice medicine in medical schools, teaching hospitals, clinics serving low-income patients predominantly, and hospitals license by Department of Community Health. It also creates a carve-out for international license holders to apply for a United States Drug Enforcement Administration registration number to write prescriptions to be filled outside the clinic if the clinic is one that services predominantly Medicaid, indigent, and underserved populations.

HB 591 allows licensed marriage and family therapists to do what similar counselors can do. That is, involuntarily commit someone at risk of harming themselves or others.

Elder Abuse Prevention

HB 605 provides guidelines for the use of video surveillance in assisted living facilities for elderly patients. The bill requires notice to the assisted living facilities before cameras may be placed. Video surveillance is essential to curb elder abuse, and while this measure sounds good, it takes away the right of elderly residents to use hidden cameras in their rooms. This bill is a reaction to a Georgia Supreme Court case that upheld the right to use hidden cameras in assisted living facilities. The bill provides no penalties for assisted living facilities that remove or disable cameras, which I think is critical to ensuring a resident’s wishes for surveillance are respected. I voted no. I expect this bill will change in the Senate, and I hope it is altered in a way to truly protect our elderly population from abuses in assisted living facilities.

Supporting Military Families

HB 303 allows motor vehicle insurance companies to provide discounted plans for active members of the United States military. To qualify to receive lower premium insurance plans, a person must be a Georgia resident, an active member of the military, and submit proof of required documents requested by the insurer. I was glad to support this bill.

Trampling on Local Control…Again

I voted against HB 302, which adds to the list of businesses for which local governments cannot impose a regulatory fee. This bill does not consider additional costs to the local government created by certain businesses, such as shooting ranges and firearm dealers.

My Efforts to Ensure that Lottery Funds are Put to Use for HOPE and Pre-K

This week I had several promising meetings regarding my proposal that we begin to use the unrestricted Lottery reserve funds that have piled up over the years—currently, over $700 million more than we are required to hold by law.

I testified with my friend Rep. Ron Stephens to the Economic Development and Tourism Committee on the Georgia Lottery Reserve Funds. You can watch HERE. The language has been added to HB 86, which is up for debate for Monday on the House floor.

COVID Update

The Fulton County COVID-19 Emergency Rental Assistance Program application period opened this past Monday. The program is open to eligible tenants in Fulton County outside the City of Atlanta. To apply and for more information about eligibility and required documents, please go to this website.

I continue to ask people to stay home, and if you have to go out, wear a mask or two, social distance, and wash your hands. HERE is a link if you need to get tested.

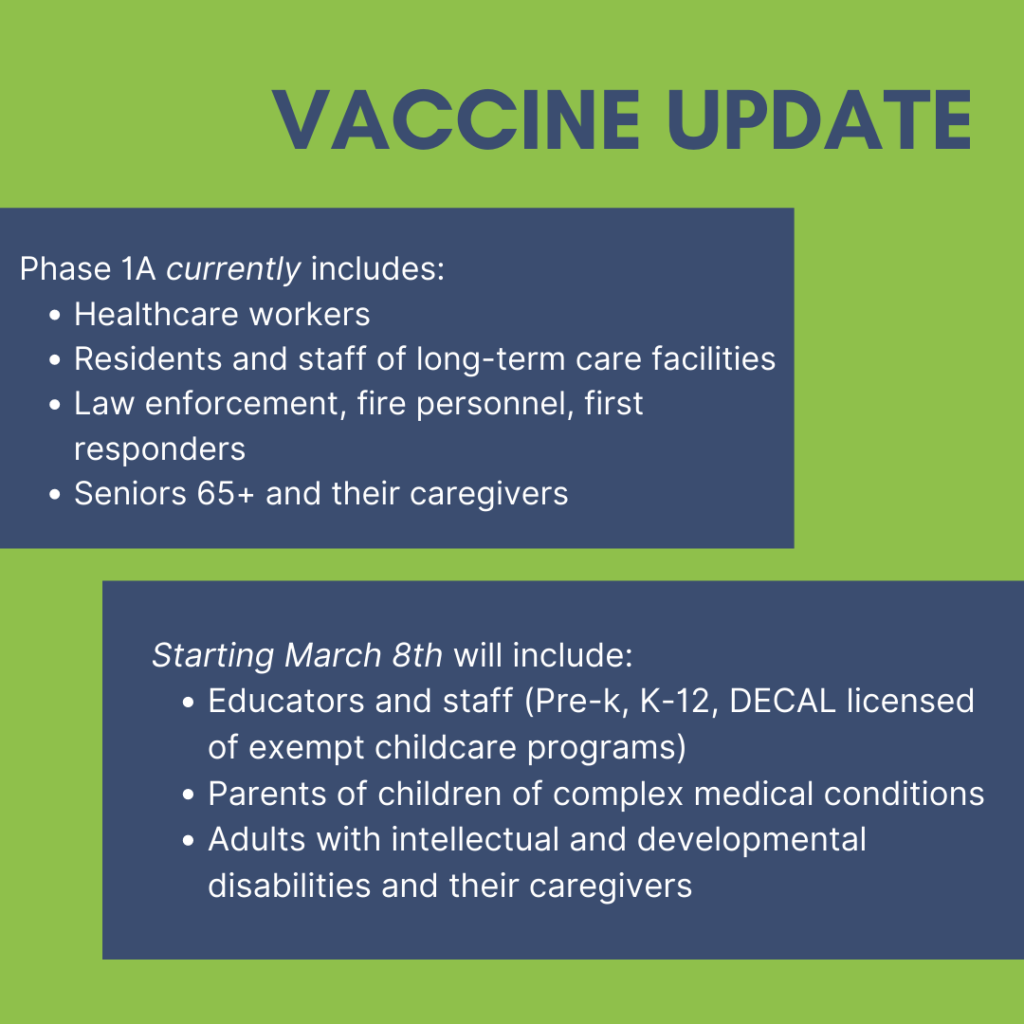

Governor Kemp announced this week that he would be adding teachers to the Phase 1A vaccine group. Vaccines will be available starting Monday, March 8th.

As a reminder for those still waiting to find an appointment, the demand for Phase 1A+ far outweighs vaccine supply. The vaccine is limited, and the state does not currently have enough supply to schedule an appointment for everyone who needs one. Many health departments are only scheduling appointments for the vaccine allotment they have and may have to pause their appointments from time to time. As more vaccine arrives, more appointments will become available. A full listing of vaccine locations accepting members of the public is available HERE.

The GEMA mass vaccination sites allow patients to enroll HERE.

Large hospital systems that received vaccines are also scheduling appointments. Many large hospitals are vaccinating their patients, including Emory, Wellstar, and Piedmont.

If you have any questions about COVID-19 and the vaccine only (not for scheduling appointments), call 888-357-0169.

Continue to let me know your opinions on legislation and community needs. I’m here to help.

Stay safe, and please let me know if there is anything I can do for you!